defer capital gains taxes indefinitely

One year is the dividing line between having to pay short term versus long term capital gains tax. You should lower the amount of capital gains tax on investments lasting 5 or 7 years when held for 10 and 15 years respectively.

Drop And Swap 1031 Exchange Exchange Connection Advisor

A 1031 exchange or like-kind exchange lets you defer taxes on the sale of.

. Sell the Property After 1 Year. There can be a big difference in the rate so it may make sense for some investors to wait at least one year before selling a property. Ad Read this guide to learn ways to avoid running out of money in retirement.

Funds must be used before age 30 or transferred to a family member under the age of 30 except for special needs beneficiaries. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. If the son were to immediately sell the real property for 650000 there would be no capital gain income taxes owed by the son.

Your first question might be what is a Deferred Sales Trust Good question. A Deferred Sales Trust is a legal arrangement between an investor and a third-party trust whereby one sells an appreciated asset while deferring ones realization of capital gains. First of all a Deferred Sales Trust aka DST is the intent of Internal Revenue Code Sec.

Ad Read this guide to learn ways to avoid running out of money in retirement. While investors can defer the tax by means of this strategy it should also be noted that they cannot use a short sale to convert a short-term capital gain into a long-term gain taxed at a lower rate. A 1031 exchange or like-kind exchange lets you defer taxes on the sale of an investment property by using the proceeds to buy another property.

A third-party deferred sales trust will reinvest your capital while indefinitely deferring your capital gains tax obligation. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether. Anyone can defer capital gains taxes indefinitely using a Deferred Sales Trust.

A Tax-Deferred Cash Out is a way of structuring the sale of an asset so that cash equivalent to a large fraction of the net selling price typically 935 can be received at closing while you defer capital gains tax 30 years. Short term capital gains are taxed as ordinary income. 453 one will not find the words Deferred Sales Trust within the code.

And capital gains tax is what you owe in state or federal taxes on capital gains realized from the sale of a capital asset. Lets say you shell out 2000 to acquire 100 shares of Acme Building Supplies at 20 per share. Investment in Acme Building Supplies is brisk and you end up selling those 100 shares at 30 per share.

New Look At Your Financial Strategy. If you sold your practice for 4 million you could end up paying 800000 to 13 million in capital gains taxes. Interest dividends and capital gains grow tax-deferred and may be distributed free of federal income taxes as long as the money is used to pay qualified education expenses.

A Section 1031 exchange can help you defer capital gains tax on appreciated property indefinitely and possibly eliminate it permanently. Under securities law the investors ownership of the stock ends at the time of the short sale not when the stock is delivered. Instead of their equity going toward the payment of income taxes an Investor will be able to exchange into larger properties with greater income potential.

Tax strategists are buzzing more and more about Deferred Sales Trusts as flexible alternatives to a 1031 exchange and valuable estate planning tools. Here are some rules and key points to understand if youre an investor looking to sell property and avoid capital gains tax using this strategy. Delaware Statutory Trusts can be used to help investors defer.

Ad Do Your Investments Align with Your Goals. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. Income Tax Calculator.

Over one-fifth of your hard-earned income is lost immediately after completing your sale. Capital losses of any size can be used to offset capital gains on your. Visit The Official Edward Jones Site.

If you have a 500000 portfolio get this must-read guide by Fisher Investments. As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero. Sell Commercial Property Postpone Paying Taxes Indefinitely Using Our Unique Proprietary Process 1031 Exchange Avoid Capital Gains Tax Tax Published May 12 2022.

Defer Capital Gain and Depreciation Recapture Taxes Indefinitely Never Pay Income. You must buy the new property for at least as much as the other one sold for or else you. If the son were to sell the real estate later for 1000000 the son would only owe capital gain income taxes on the 350000 gain.

This strategy can be applied to a wide variety of asset types and is a compelling alternative to more widely-known. A DST could defer capital gains tax obligations indefinitely while producing cash flow on the sale of any appreciated asset not just real property. There is also 30 Income Tax relief on the investment.

As long as you use the proceeds to re-invest you can defer taxes on investment properties indefinitely. Both kinds of DSTs can be used to defer capital gains taxes but they do so in different ways. Freedom Bridge Capital Deferred Sales Trust is an alternative to paying the enormous sums associated with capital gains tax.

A 15 option must be used before the end of 2019 as it is only available for investment in 2020. A 1031 exchange allows a taxpayer to postpone their long-term capital gains tax when selling an investment property by exchanging both the basis and the gain into a new investment. Structuring real estate transactions as 1031 tax-deferred exchanges allows an Investor to defer 100 of their income tax liabilities.

Theoretically these taxes could be deferred forever which well get to later. What is a 1031 Exchange. Lets say you purchased a single-family investment home for 100000.

Lets call that Property A. The gain is deferred until December 31 2026or to the year when the. When it comes to 1031 Exchanges they should always be.

If the gain is re-invested into a Seed EIS in the same tax year CGT relief of 50 is given. 453However when reading Sec. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

Find a Dedicated Financial Advisor Now. If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years.

Real Estate Fact Sheet Template Google Docs Word Apple Pages Template Net Fact Sheet Facts Templates

The Hierarchy Of Tax Preferenced Savings Vehicles Investing For Retirement Higher Income Hierarchy

Equity Carve Outs Advantages And Disadvantages Equity Accounting And Finance Economics Lessons

The Major Distinction Between Condo Vs Co Op Is Exactly What You Will Actually End Up Owning A Co Op Owner Does Not Own The Unit House Hunters The Unit Condo

Commercial Real Estate Investing Real Estate Investor Commercial Real Estate

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

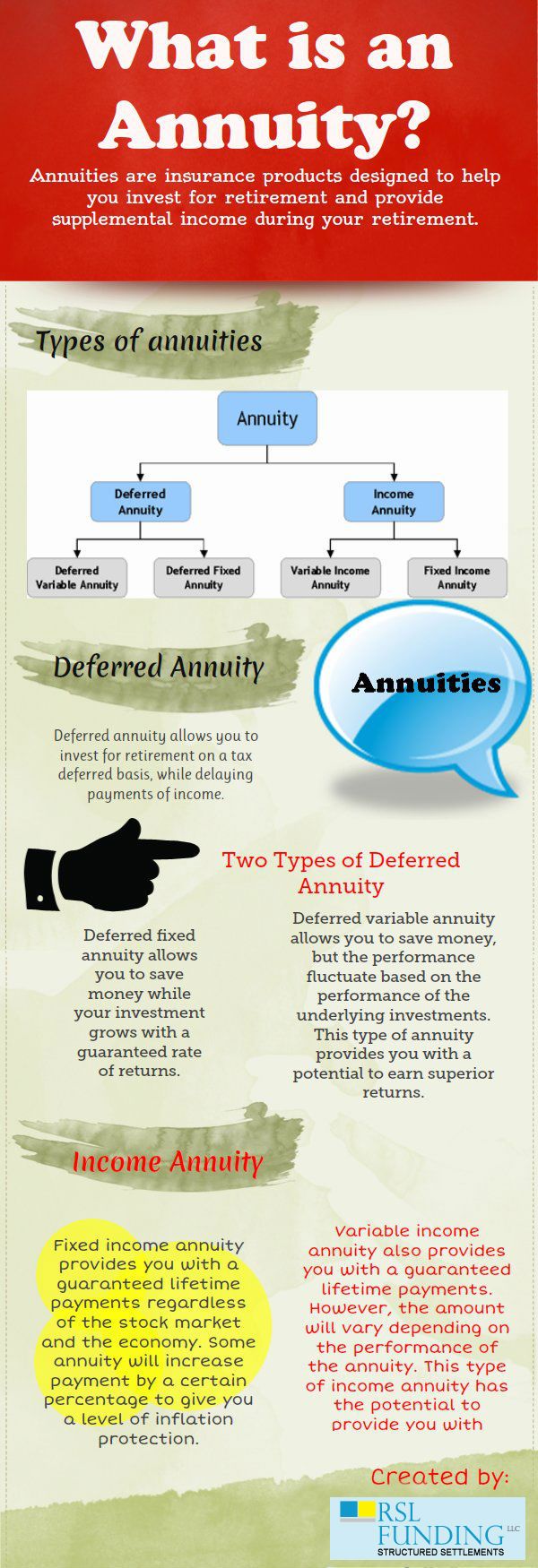

What Is An Annuity Investing For Retirement Annuity Finance Investing

The Tax Free Savings Account Tfsa Is One Of The Best Investment Vehicles Available To Canadians But Most Peop Tax Free Savings Savings Account Savings Chart

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Frank Advising Home Frank Advising Financial Advisors Financial Savvy Investing

How To Work With Lenders For The Brrrr Method A Massive Open Secret To Brrrr Success Open Secrets Real Estate Infographic Lenders

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Credit Scores 101 Understand Exactly What Goes Into The Calculation With This Easy Visual And Get Step By Step I Credit Score Fico Credit Score Fix My Credit

Pin By Cooltripbro On Financial Budgeting Money Investing Finances Money

Difference Between Epf And Ppf Income Investing Investing Basic